All Categories

Featured

Table of Contents

The $40,000 increase over the initial bid is the tax sale excess. Claiming tax sale excess suggests obtaining the excess money paid throughout an auction.

That stated, tax obligation sale overage claims have shared characteristics across the majority of states. Typically, the area holds the cash for a specified period depending on the state. Throughout this duration, previous owners and home mortgage holders can call the county and get the excess. However, regions usually do not locate past owners for this objective.

If the duration ends before any interested parties claim the tax obligation sale excess, the area or state generally soaks up the funds. Past proprietors are on a stringent timeline to claim overages on their properties.

, you'll make interest on your whole proposal. While this aspect does not indicate you can claim the excess, it does help reduce your expenses when you bid high.

World-Class Unclaimed Tax Sale Overages Learning Tax Sale Overage Recovery

Remember, it might not be legal in your state, suggesting you're restricted to collecting interest on the overage. As specified above, an investor can discover methods to benefit from tax sale excess. Real Estate Overage Recovery. Since passion earnings can put on your entire bid and previous proprietors can declare overages, you can leverage your expertise and devices in these circumstances to optimize returns

A critical element to remember with tax sale overages is that in most states, you just require to pay the region 20% of your total proposal up front. Some states, such as Maryland, have legislations that surpass this guideline, so again, study your state legislations. That said, most states adhere to the 20% guideline.

Rather, you just need 20% of the bid. If the property does not redeem at the end of the redemption period, you'll need the remaining 80% to obtain the tax obligation deed. Because you pay 20% of your quote, you can gain rate of interest on an overage without paying the full cost.

Elite Tax Sale Overages Program Tax Foreclosure Overages

Once more, if it's legal in your state and area, you can work with them to aid them recover overage funds for an extra fee. You can gather interest on an overage quote and charge a cost to streamline the overage insurance claim process for the past owner.

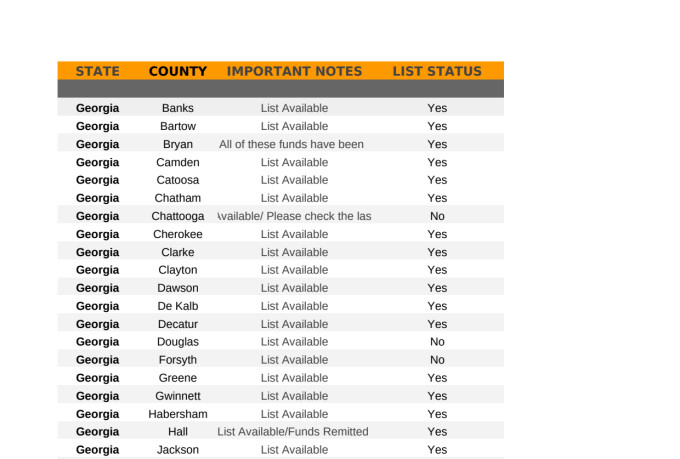

Overage collectors can filter by state, region, residential property type, minimum overage quantity, and optimum excess amount. As soon as the data has been filteringed system the collectors can determine if they intend to add the skip mapped information plan to their leads, and after that pay for just the validated leads that were located.

In addition, just like any type of various other financial investment strategy, it offers unique pros and disadvantages.

Tax Overages Business Opportunities Unclaimed Tax Overages

Tax sale overages can create the basis of your financial investment model because they provide a cost-effective method to earn money. You do not have to bid on buildings at auction to invest in tax sale excess.

Doing so does not set you back hundreds of thousands of bucks like buying numerous tax liens would certainly. Rather, your research, which might include skip mapping, would cost a comparatively tiny fee. Any type of state with an overbid or exceptional quote method for public auctions will certainly have tax sale overage opportunities for capitalists. Keep in mind, some state laws avoid overage options for previous proprietors, and this concern is actually the subject of a present Supreme Court instance.

Efficient Tax Sale Overage Recovery Learning Overages List By County

Your sources and method will certainly determine the finest setting for tax obligation overage investing. That stated, one method to take is gathering passion on high premiums.

Any kind of public auction or foreclosure entailing excess funds is a financial investment opportunity. You can spend hours investigating the previous owner of a residential property with excess funds and contact them just to discover that they aren't interested in pursuing the money.

You can begin a tax obligation overage business with marginal expenditures by finding details on current residential properties offered for a premium quote. You can contact the past proprietor of the residential property and provide a price for your services to assist them recover the overage. In this scenario, the only expense entailed is the study instead of spending 10s or hundreds of thousands of bucks on tax liens and deeds.

These excess generally produce interest and are offered for previous proprietors to insurance claim - Tax Overages List. Whether you spend in tax obligation liens or are entirely interested in insurance claims, tax obligation sale overages are investment chances that need hustle and strong research to transform an earnings.

Exclusive Real Estate Overage Funds Program Tax Foreclosure Overages

A party of rate of interest in the property that was cost tax sale might assign (transfer or sell) his/her right to claim excess proceeds to another person just with a dated, written paper that clearly specifies that the right to assert excess profits is being designated, and just after each party to the suggested job has actually divulged to each other party all truths associating with the value of the right that is being designated.

Tax sale excess, the surplus funds that result when a home is cost a tax sale for greater than the owed back tax obligations, charges, and prices of sale, represent a tantalizing chance for the original homeowner or their successors to recoup some value from their shed asset. The procedure of declaring these overages can be complicated, bogged down in lawful treatments, and vary dramatically from one territory to one more.

When a residential property is offered at a tax obligation sale, the primary objective is to recuperate the unsettled building tax obligations. Anything above the owed quantity, including penalties and the price of the sale, comes to be an excess - Bob Diamond Overages. This overage is essentially money that should rightfully be gone back to the former residential or commercial property proprietor, assuming no various other liens or insurance claims on the property take precedence

Table of Contents

Latest Posts

Tax Liens And Deeds Investing

Tax Lien Deed Investing

Tax Lien Investing Scams

More

Latest Posts

Tax Liens And Deeds Investing

Tax Lien Deed Investing

Tax Lien Investing Scams