All Categories

Featured

Table of Contents

Accredited capitalists have accessibility to financial investment possibilities that are used privately under Guideline D of the Securities Act. These are not openly supplied chances readily available to the basic spending public - certified investor. Generally, these investments could be riskier, yet they use the opportunity for possibly greater returns. Historically, the SEC difference was to mark people that are considered to be extra innovative financiers.

Exclusive firms can offer securities for investment that are not readily available to the public. These safety and securities products can include: Financial backing Finances (VC)Angel InvestingHedge FundsPrivate Equity OpportunitiesEquity Crowdfunding There are likewise additional personal financial investment safety and securities that can be accessed by certified capitalists. The definition and requirements of this kind of investor certification have actually remained leading of mind given that its beginning in the 1930s.

Investment Qualifications

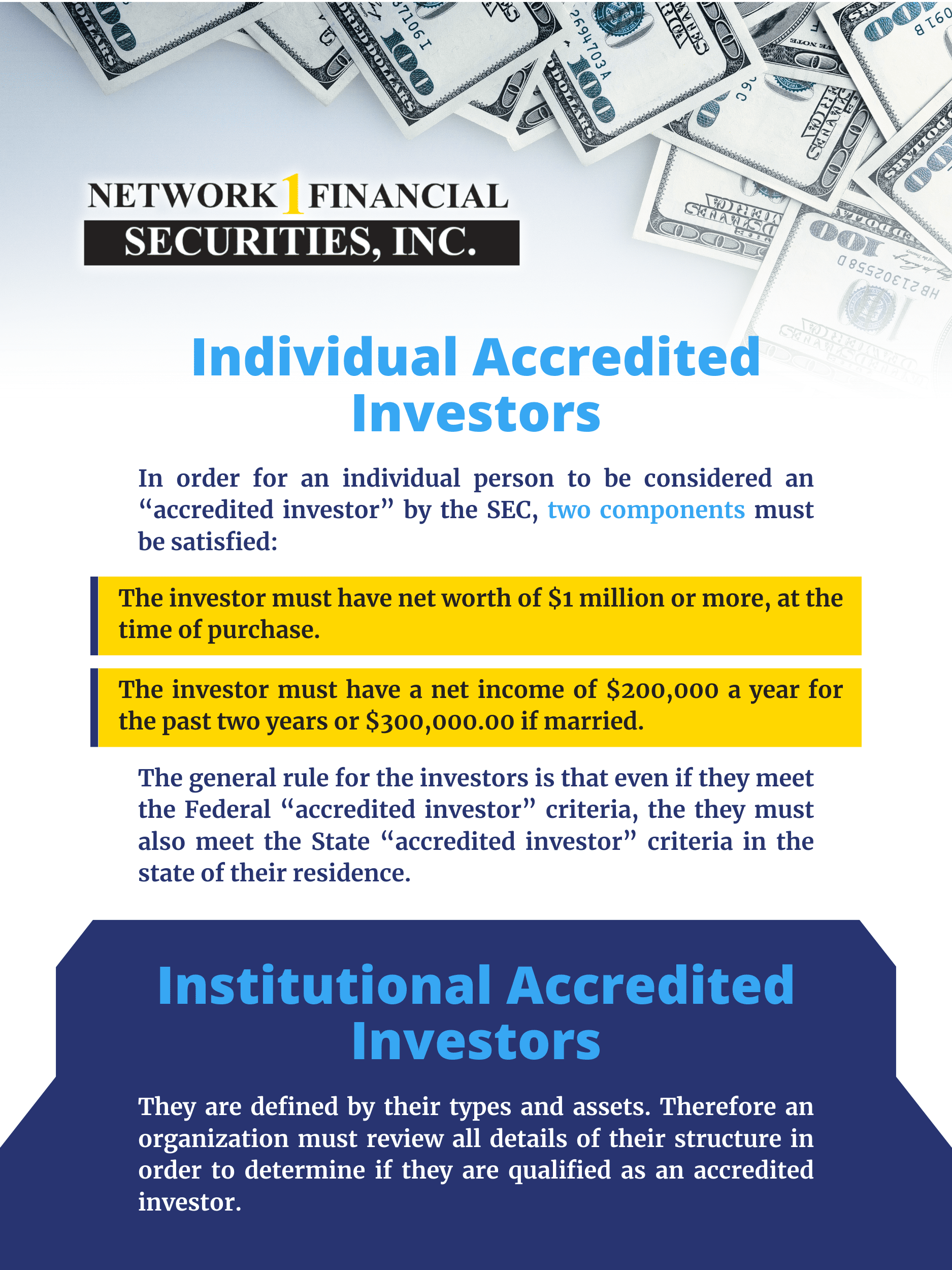

These needs are meant to guarantee that investors are well-informed sufficient to comprehend the dangers of these financial investment opportunities. They additionally function to guarantee that prospective capitalists have enough wide range to protect versus financial loss from riskier investments. Today, the parameters for certified capitalists remain to be a hot subject.

Others believe that certified standing should be based on their spending acumen. This will continue to be a hotly questioned subject among the economic group.

Non-accredited capitalists were initial able to invest in the Fund in August 2020. Certified investors may participate in all our financial investment items with their Yieldstreet Individual retirement account.

As for exactly how a lot this will certainly impact the marketplace relocating onward, it's most likely prematurely to tell. When even more and a lot more qualified financiers look for accreditation, it will certainly be much easier to establish just how this new judgment has increased the market, if at all. If you have extra concerns concerning the Fund, please get to out to the Yieldstreet group at [e-mail shielded].

Can An Llc Be An Accredited Investor

Capitalists ought to meticulously take into consideration the financial investment purposes, dangers, charges and expenditures of the YieldStreet Alternative Income Fund before investing. The prospectus for the YieldStreet Choice Income Fund includes this and other details about the Fund and can be acquired by describing . The prospectus needs to read carefully before purchasing the Fund.

The safeties defined in the program are not sold in the states of Nebraska, Texas or North Dakota or to persons resident or located in such states (qualified investor us). No membership for the sale of Fund shares will be accepted from any type of individual citizen or located in Nebraska or North Dakota

(SEC).

The demands of who can and that can not be an approved investorand can take part in these opportunitiesare figured out by the SEC. There is a typical mistaken belief that a "process" exists for a private to become an accredited capitalist.

Accredited Investor 501

The worry of verifying an individual is a recognized investor drops on the financial investment lorry instead than the capitalist. Pros of being a recognized financier consist of access to unique and limited financial investments, high returns, and raised diversity. Disadvantages of being a recognized investor include high danger, high minimum investment quantities, high costs, and illiquidity of the investments.

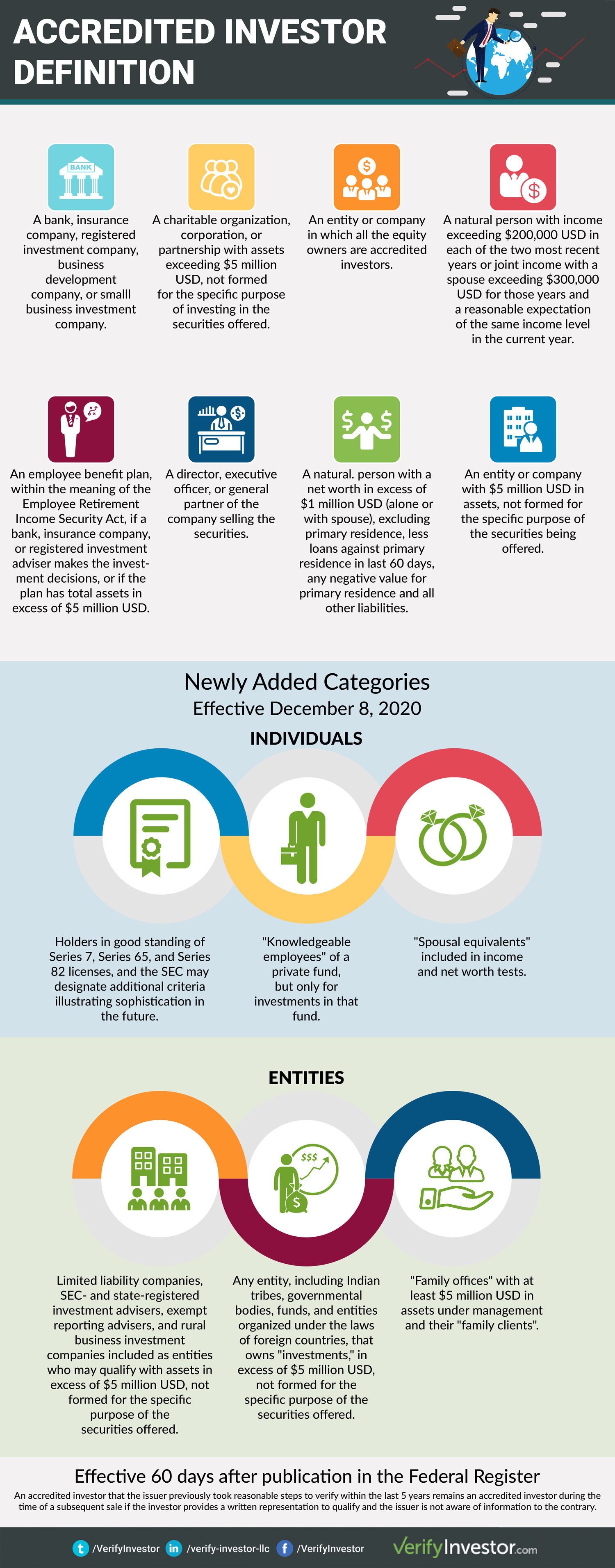

D) offers the interpretation for an accredited investor. Just placed, the SEC defines a certified financier through the confines of income and internet well worth in 2 methods: An all-natural individual with revenue surpassing $200,000 in each of the 2 most recent years or joint income with a spouse going beyond $300,000 for those years and a practical assumption of the very same earnings level in the current year.

Approximately 14.8% of American Families qualified as Accredited Investors, and those families controlled about $109.5 trillion in riches in 2023 (sec accreditation). Measured by the SCF, that was around 78.7% of all private wealth in America. Rule 501 likewise has arrangements for companies, collaborations, charitable companies, and trust funds in enhancement to firm supervisors, equity proprietors, and economic establishments

The SEC can include certifications and designations going ahead to be included in addition to motivating the general public to submit proposals for other certificates, classifications, or qualifications to be taken into consideration. Staff members who are taken into consideration "educated workers" of a private fund are now additionally taken into consideration to be certified investors in concerns to that fund.

People who base their credentials on yearly revenue will likely need to submit tax obligation returns, W-2 types, and various other documents that show salaries. Individuals might likewise consider letters from evaluations by CPAs, tax obligation lawyers, investment brokers, or advisors. Accredited financier classifications additionally exist in various other nations and have comparable requirements.

Real Estate For Accredited Investors

In the EU and Norway, as an example, there are 3 tests to identify if an individual is a certified financier. The initial is a qualitative examination, an evaluation of the individual's know-how, understanding, and experience to establish that they can making their very own financial investment choices. The 2nd is a quantitative examination where the person needs to satisfy 2 of the adhering to criteria: Has actually performed purchases of significant size on the appropriate market at an ordinary regularity of 10 per quarter over the previous 4 quartersHas a financial profile surpassing EUR 500,000 Works or has actually operated in the monetary field for at least one year Last but not least, the customer has to state in written form that they desire to be dealt with as an expert customer and the company they want to work with should provide notification of the protections they can shed.

Pros Accessibility to more investment chances High returns Enhanced diversity Disadvantages Risky investments High minimal financial investment amounts High efficiency costs Lengthy resources lock up time The primary advantage of being an accredited investor is that it gives you a monetary advantage over others. Due to the fact that your net worth or wage is already among the highest possible, being an approved financier permits you access to investments that with much less wealth do not have accessibility to.

Sec Accredited Investors

One of the most basic examples of the advantage of being a recognized investor is being able to invest in hedge funds. Hedge funds are primarily just easily accessible to accredited financiers since they require high minimum financial investment quantities and can have greater affiliated risks however their returns can be remarkable.

There are likewise disadvantages to being a certified capitalist that connect to the financial investments themselves. Many financial investments that need a specific to be a recognized financier featured high risk. The strategies used by many funds featured a higher risk in order to attain the goal of beating the marketplace.

Llc Accredited Investor

Just transferring a couple of hundred or a few thousand bucks into a financial investment will certainly not do. Recognized financiers will need to dedicate to a couple of hundred thousand or a couple of million bucks to take part in investments implied for accredited financiers (private placement accredited investor leads list). If your financial investment goes southern, this is a great deal of money to shed

These largely can be found in the form of efficiency fees in addition to monitoring costs. Efficiency costs can range between 15% to 20%. Another con to being a recognized investor is the capacity to access your investment funding. For example, if you buy a couple of stocks online with a digital system, you can pull that cash out any kind of time you like.

A financial investment car, such as a fund, would certainly need to figure out that you certify as a recognized capitalist. To do this, they would ask you to load out a set of questions and potentially give certain records, such as monetary statements, credit report reports, or income tax return. The benefits of being a recognized financier consist of accessibility to special financial investment opportunities not offered to non-accredited capitalists, high returns, and enhanced diversity in your portfolio.

In specific areas, non-accredited investors also deserve to rescission. What this means is that if an investor determines they desire to pull out their money early, they can claim they were a non-accredited capitalist the whole time and get their cash back. It's never ever a good idea to offer falsified records, such as phony tax returns or economic statements to an investment car simply to spend, and this might bring lawful problem for you down the line.

That being stated, each offer or each fund may have its own restrictions and caps on financial investment quantities that they will certainly approve from an investor. Accredited financiers are those that meet certain requirements concerning revenue, qualifications, or internet well worth.

Table of Contents

Latest Posts

Tax Liens And Deeds Investing

Tax Lien Deed Investing

Tax Lien Investing Scams

More

Latest Posts

Tax Liens And Deeds Investing

Tax Lien Deed Investing

Tax Lien Investing Scams